Transition Finance Weekly, Special Edition

Pleiades Strategy’s 2025 Statehouse Report on “Anti-ESG” Bills

This week’s edition is all about our 2025 Statehouse Report, tracking how the fossil fuel-backed “anti-ESG” effort evolved its strategy on the floors of state legislatures this session. I extend my deep thanks to brilliant co-authors Connor Gibson and Jeremy Siegel, as well as the many others who helped bring this report to fruition. — Frances Sawyer

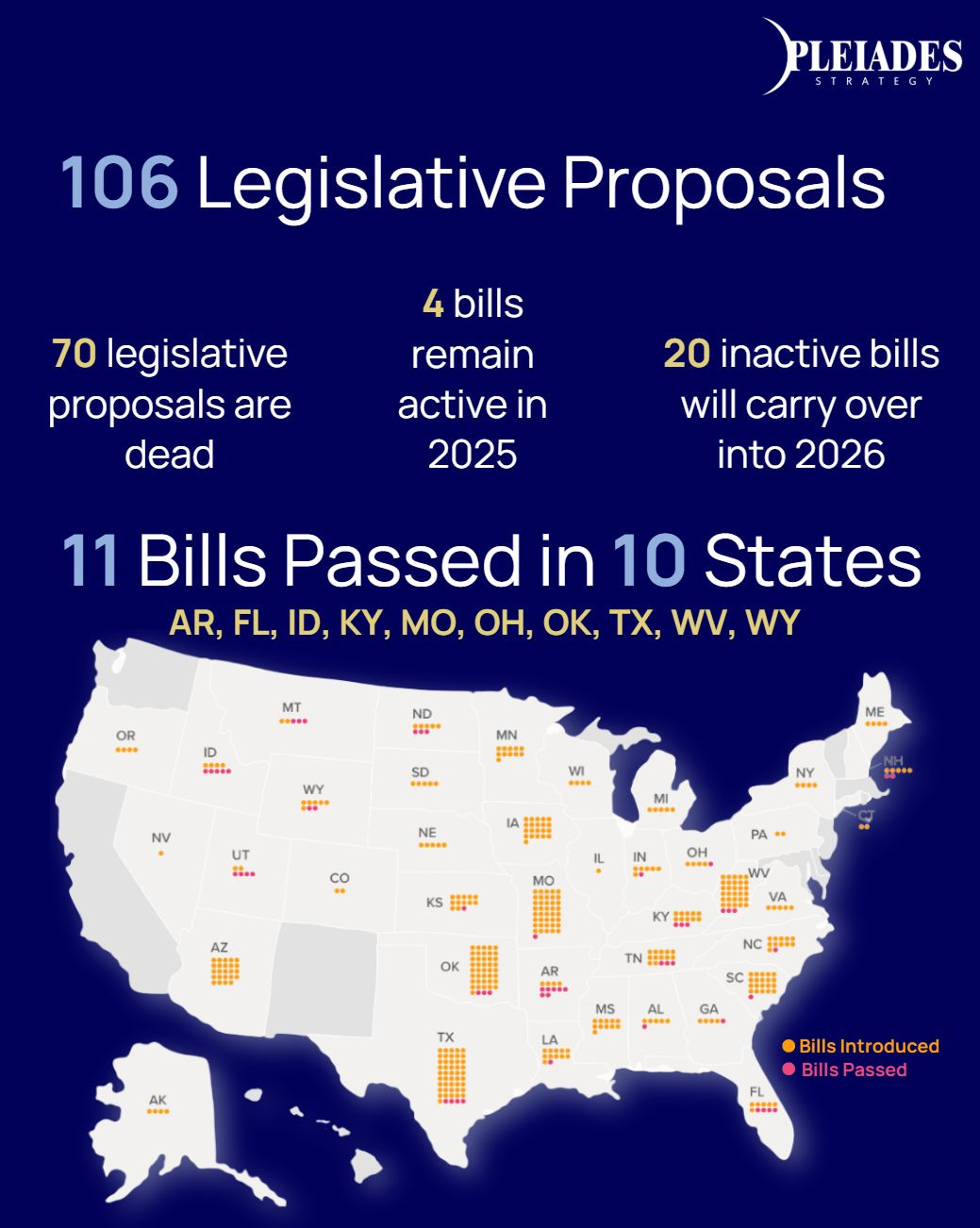

SPOTLIGHT on State “Anti-ESG” Bills: 106 Introduced, 11 Passed

Opponents of clean energy continue to wage their assault on climate action and responsible investing, introducing 106 bills this year in dozens of states and passing 11 — all while the economic risks of climate change grow more urgent and visible in our economy, hitting companies, pensionholders, and taxpayers increasingly hard.

It’s important to remember who is behind these bills: fossil fuel companies and their cadre of lobbyists and legislators. Even when bills fail to pass, they create pressure on companies and public agencies to favor an incumbent industry facing real competition from cleaner, more efficient competitors. These policies encourage ignoring risks, instead of smart risk-based investing, and delay the clean energy transformation and climate progress.

And this year, the proponents of these bills were emboldened by a president and Congressional majority that are actively seeking to dismantle climate, environmental, and financial regulatory policies and programs that keep people safe and energy affordable.

Alongside policies that support the fossil fuel industry, we have watched as “anti-ESG” efforts seek to weaponize state funds in the culture wars, in particular supporting the erasure of DEI practices, the ending of common-sense gun safety initiatives, and the blocking of reasonable credit risk decisions regarding organized hate groups. Together, these policies reflect a new politicized approach to how policymakers seek to shape the capital markets.

As an example, this year, we saw the “anti-ESG” campaigns take up highly controversial so-called “debanking” bills, which weaponize civil rights language to pretend that making a rational decision not to invest in or trade with oil companies, gun manufacturers, and Christian nationalist groups constitutes “discrimination”:

Idaho passed a sweeping “debanking” law requiring financial institutions to serve hate groups and polluters.

Florida passed similar protections for Big Ag.

Most of this year’s anti-ESG bills failed, but the continued introduction and debate around these proposals have still succeeded in chilling responsible investing and encouraging “greenhushing” — companies’ quiet abandonment of climate goals to avoid right-wing attacks. Several major financial players have pulled out of global climate alliances like Climate Action 100+, the Net Zero Banking Alliance, and the Net Zero Asset Managers initiative, even as climate risk is materializing across the value chain more than ever.

Reality matters, though. Climate risk is financial risk, and the clean energy transition is well underway. Acting upon this information protects the bottom line, protects returns, and provides a pathway to global economic leadership.

With headwinds from anti-ESG policies impairing a smart response to this reality, it is incumbent on the private sector and reasonable state lawmakers to ensure they are taking material climate risks into account. They must respond with common sense and actively resist intimidation — to protect investors, people, companies, and local governments.

Frances Sawyer, co-author of the report: “Climate economic shocks are here. Right-wing extremists, backed by the fossil fuel sector, have been working nonstop to undermine responsible investment practices in several states across the country under the framework of ‘anti-ESG’ legislation. These policies are costly for investors, pensionholders, municipalities, and taxpayers, and it’s critically important that other states, investors, and companies hold the line amid rising climate costs and risks — and protect the right to respond to the climate crisis rationally.”